cryptocurrency tax calculator ireland

Cryptocurrency tax calculator ireland Thursday March 3 2022 Edit. Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier.

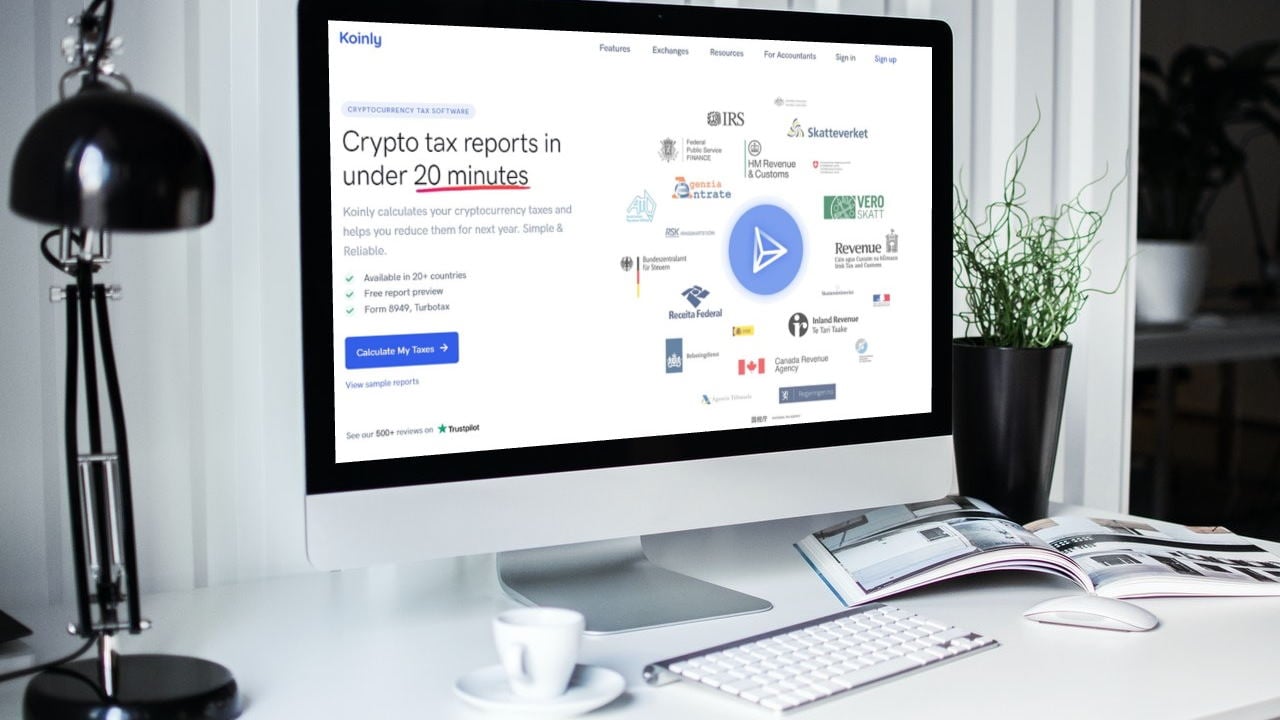

Koinly Review Our Thoughts Pros Cons 2022

What is a Crypto Tax Calculator.

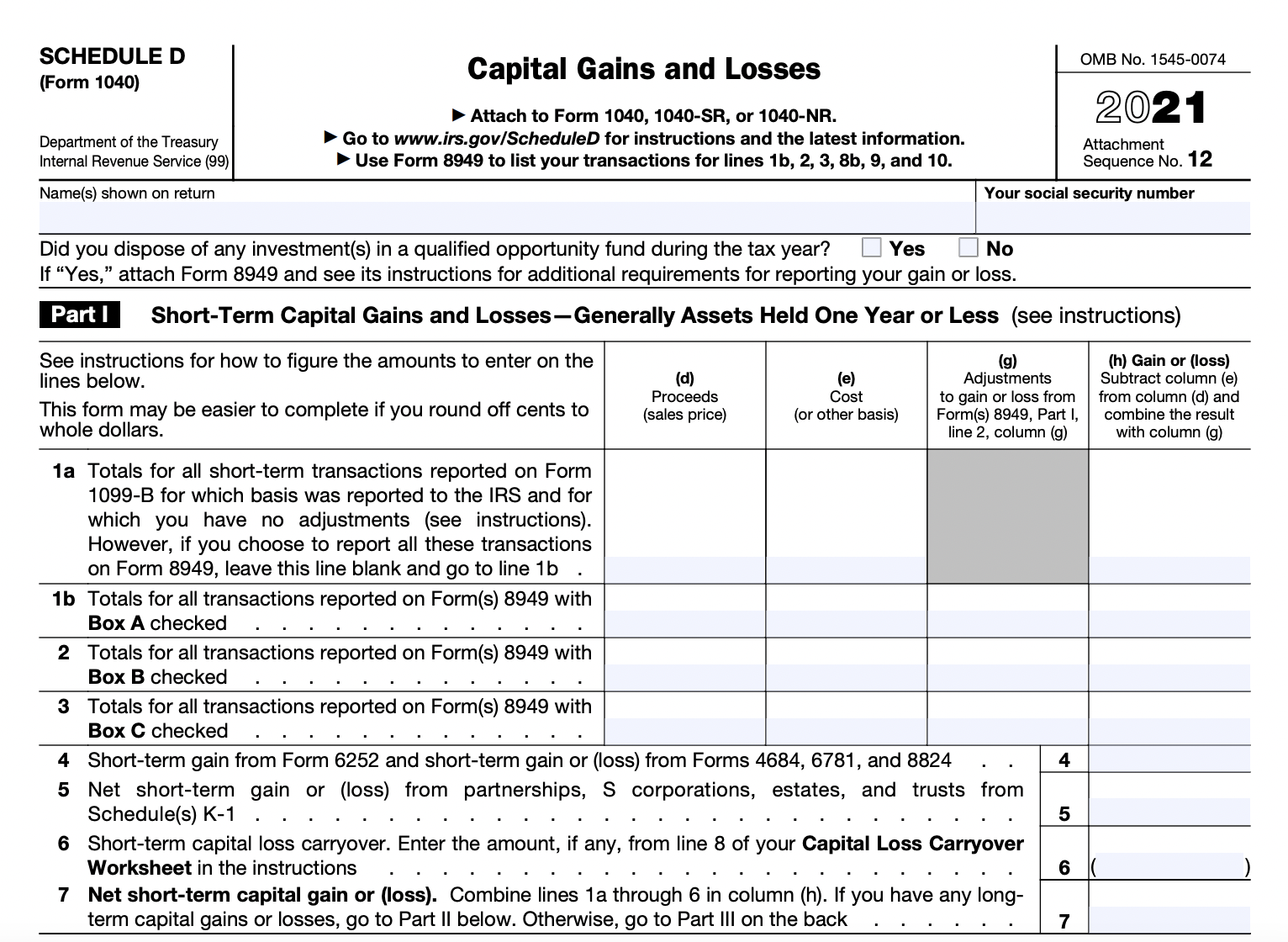

. Direct tax treatment of cryptocurrencies. Enter your taxable income minus any profit from crypto sales. Capital gains tax CGT form.

Best Places to buy Bitcoin Online. Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier. But calculating each taxable transaction and.

Cryptocurrencies and crypto-assets. See Taxation of crypto-asset transactions for guidance on. Direct tax treatment of cryptocurrencies.

You then deduct your personal exemption to find your taxable gain which is 2000 - 1270 730. Allowable Costs As well as your personal exemption you can also deduct any. CoinTrackinginfo - the most popular crypto tax calculator.

This will often be the same as your adjusted gross income AGI. Cryptocurrency Tax Ireland. This is especially due to the complex rules for offsetting gains with losses applicable in Ireland.

Just type in your gross salary select how frequently youre paid. Basic rate 20 on earnings 12570 to 50270 if this is your main. Under Add A Sale.

A cryptocurrency tax calculator like Coinpanda has full support for. The Result is. As with any other activity the treatment of income received from charges.

Best Places to buy Bitcoin Online. Crypto tax calculators like CoinLedger can help you generate a comprehensive tax report in minutes. How to Use the Tax Calculator for Ireland You can use our Irish tax calculator to estimate your take-home salary after taxes.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland. The direct taxes are corporation tax income tax and capital gains tax. Enter your income for the year.

With the standard CGT rate of 33 the amount of tax you will have to pay will be 730 x 033 24090. The amount of tax youll pay on crypto depends on the specific transaction youve made the tax that applies and how much. How much tax do you pay on crypto in Ireland.

Choose your tax status. If you are an Irish citizen you will need to file your capital gains from crypto trading on a Capital Gains Tax form for both the Initial and Later periods. Remember the calculator featured above is a simplified.

Input your state tax rate. READ NEXT - Calculator shows how much bills. There are no special tax rules for cryptocurrencies or crypto-assets.

Choose how long you have owned this crypto. Both Capital Gains Tax and Income Tax apply to crypto in Ireland and any capital gains or income needs to be included in your annual tax return. Tax-Loss Harvesting With A Crypto Tax.

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

How To Report Crypto On Tax Forms 8949 And 1040 Tokentax

Crypto Tax Calculator Review October 2022 Finder Com

Free Crypto Tax Calculator Coinledger

The 2022 Guide To Income And Estate Taxation Of Cryptocurrency And Nfts Or Non Fungible Tokens Sf Tax Counsel

Hong Kong Positioned As The Most Crypto Ready Country In 2022

Crypto Taxes In 2022 All You Need To Know According To Koinly Sponsored Bitcoin News

Koinly Review 2022 Cryptocurrency Tax Platform To Simplify Tax Reports

Find The Best Crypto Tax Software For Reporting Your 2021 Taxes

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick

Australia S Cryptotaxcalculator Helps Traders Demystify The Decentralized Techcrunch

Koinly Review And Alternatives Is It The Best Crypto Listy

Tax On Cryptocurrency In Ireland Money Guide Ireland

![]()

Cointracking Crypto Tax Calculator

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Crypto Taxes In Ireland The Complete Guide Bitcointaxes

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick