operating cash flow ratio ideal

A higher ratio greater than 10 is preferred by investors creditors and analysts as it means a company can cover its current short-term liabilities and still have earnings left. What Is A Good Operating Cash Flow To Current Liabilities Ratio.

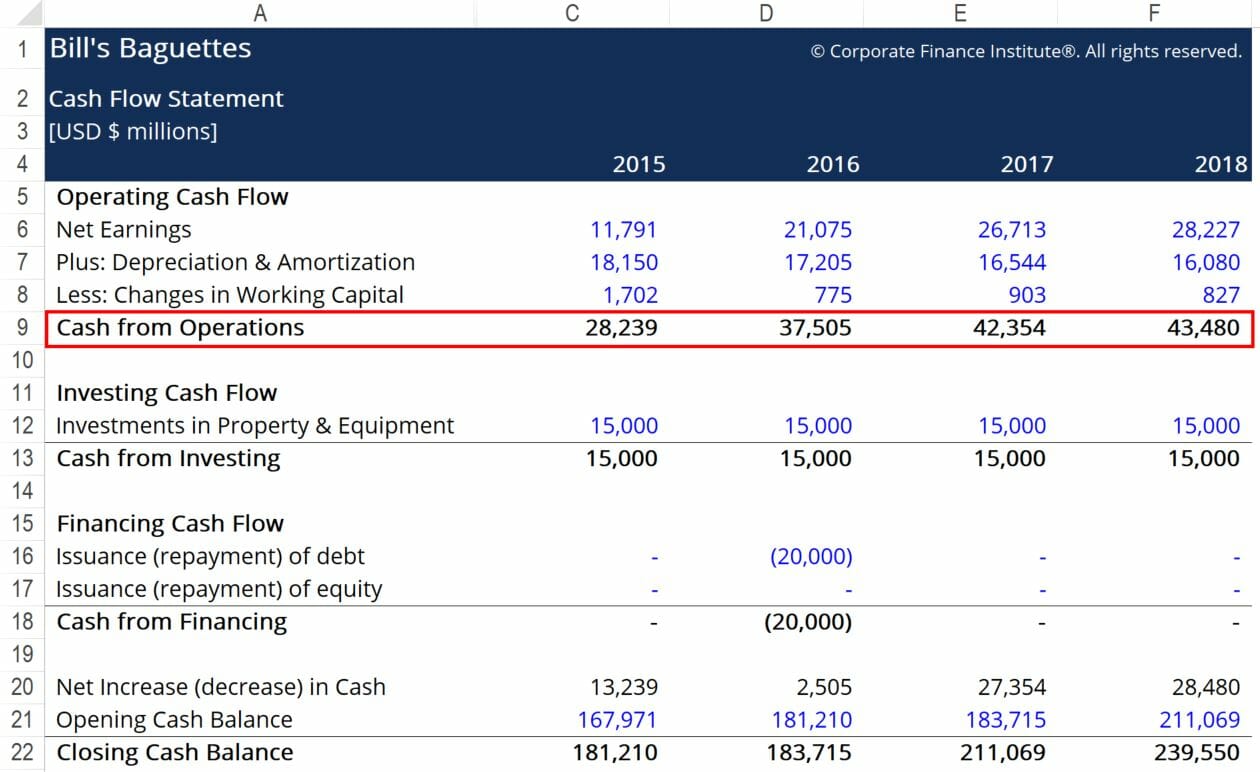

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

The CAPEX to Operating Cash Ratio is a financial risk ratio that assesses how much emphasis a company is placing upon investing in capital-intensive projects.

. Cash flow ratios compare cash flows to other elements of an entitys financial statements. Over time a businesss. Operational cash flow shows how much money you generate from your companys core purpose.

It measures the amount of operating cash flow generated per share of stock. Operating cash flow ratio is an important measure of a companys liquidity ie. Free cash flow is the cash that a company generates from its business operations after subtracting.

This ratio can be calculated from the following formula. 250000 120000 208. Thus in this case the operating.

Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100. Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100 The. EV to CFO Enterprise Value Cash Flow from Operations.

EVCFO Market Capitalization Debt Outstanding Available Cash with the Firm. The ideal ratio is close to one. A higher ratio is more desirable.

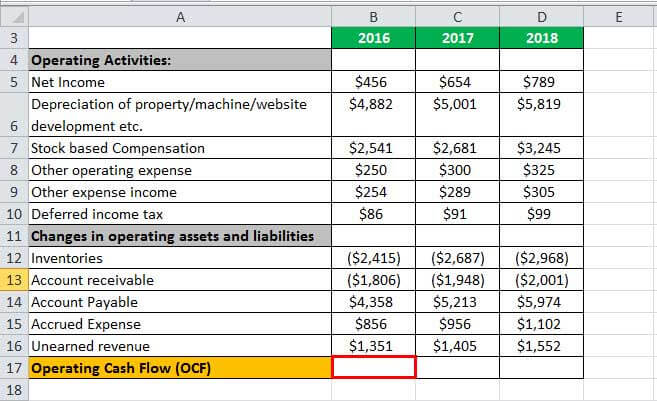

The calculation of the operating cash flow ratio first calls for the derivation of cash flow from operations which requires the. How to Calculate the Operating Cash Flow Ratio. Operating cash flow measures cash generated by a companys business operations.

However they have current liabilities of 120000. A higher level of cash flow indicates a better ability to withstand declines in. Free cash flow is the cash that a company generates from its business.

The operating cash flow ratio also known as a liquidity ratio is an indicator which helps to determine whether a company is able to repay its current liabilities with cash flow coming. The operating cash flow ratio is a measure of a companys liquidity. If the ratio is less.

Businesses which have very little cash flow from outside their. Operating cash flow ratio is. This means that for every 1 unit of net sales the company.

So a ratio of 1. A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate. Operating cash flow ratio CFO Current liabilities.

Targets operating cash flow ratio works out to 034 or 6 billion divided by 176 billion. Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow. There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations.

You can work out the operating cash flow ratio like so. For instance if 90 days receivables are outstanding it means on an average the company extends credit for 90360 25 of its sales at any given point of time. It should at least be close to 111 in most cases.

If the operating cash flow is less than 1 the company has generated less cash in the period than it. The figure for operating cash flows can be. Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100.

The operating cash flow ratio for Walmart is 036 or 278 billion divided by 775 billion. Ideally the projects that a. This means that Company A earns 208 from operating.

Operating Cash Flow Margin Cash Flow from Operations Net Sales. Operating cash flow ratio is used to understand if a company can pay off its liabilities or payables. The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded.

The operating cash flow ratio is a measure of a companys liquidity. Operating Profit Ratio Operating ProfitNet Sales100. A higher ratio is better.

Although there is no one-size-fits-all ideal ratio for every company out there as a general rule the higher the Operating. You can work out the operating cash flow. This is because it shows a better ability to cover current liabilities using the money.

Another more popular and precise formula.

Operating Cash Flow Ratio Formula Guide For Financial Analysts

Price To Cash Flow Ratio Formula Example Calculation Analysis

Operating Cash Flow Ratio Definition Formula Example

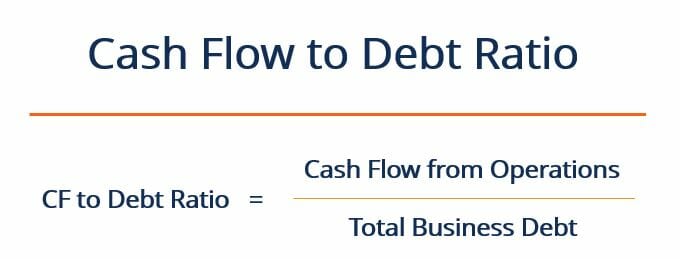

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Formula Calculation With Examples

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow Ratios Calculator Double Entry Bookkeeping

How Do Net Income And Operating Cash Flow Differ

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Operating Cash Flow Formula Calculation With Examples

Capex To Operating Cash Ratio Definition Example Corporate Finance Institute

Operating Cash Flow Ratio Calculator

Free Cash Flow Formula Calculator Excel Template

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)